Overview

Nice is the crown jewel of the French Riviera and the fifth-largest city in France. With 300+ days of sunshine, a stunning coastline, and excellent transport links (including an international airport), Nice attracts buyers from around the world.

Market trend (recorded transactions)

€4,826/m² (IQR (p25–p75): €3,867–€6,000/m², n=1,471). +2.2% YoY · +0.1% QoQ. Source: DVF (DGFiP) (Open Licence 2.0).

QoQ = change vs previous quarter. YoY = change vs the same quarter last year. IQR (p25–p75) = middle 50% of deals.

Market activity: Q2–Q3 (based on deal count; DVF is delayed). Activity ≠ price.

| Quarter | Deals | Median €/m² | IQR (p25–p75) | QoQ | YoY |

|---|---|---|---|---|---|

| 2024-Q1 | 1,189 | €4,792 | €3,621–€5,864 | +3.4% | +1.6% |

| 2024-Q2 | 1,348 | €4,722 | €3,731–€6,042 | -1.5% | -1.2% |

| 2024-Q3 | 1,551 | €4,815 | €3,796–€6,094 | +2.0% | +0.7% |

| 2024-Q4 | 1,473 | €4,750 | €3,750–€6,029 | -1.3% | +2.5% |

| 2025-Q1 | 1,539 | €4,821 | €3,774–€6,218 | +1.5% | +0.6% |

| 2025-Q2 | 1,471 | €4,826 | €3,867–€6,000 | +0.1% | +2.2% |

Show 5-year quarterly history (apartments) — 2020-Q3 → 2025-Q2

| Quarter | Deals | Median €/m² |

|---|---|---|

| 2020-Q3 | 1,820 | €4,052 |

| 2020-Q4 | 2,112 | €4,164 |

| 2021-Q1 | 1,694 | €4,250 |

| 2021-Q2 | 1,980 | €4,200 |

| 2021-Q3 | 1,918 | €4,342 |

| 2021-Q4 | 1,784 | €4,306 |

| 2022-Q1 | 1,824 | €4,333 |

| 2022-Q2 | 2,137 | €4,435 |

| 2022-Q3 | 2,094 | €4,597 |

| 2022-Q4 | 1,767 | €4,679 |

| 2023-Q1 | 1,656 | €4,716 |

| 2023-Q2 | 1,747 | €4,778 |

| 2023-Q3 | 1,598 | €4,782 |

| 2023-Q4 | 1,317 | €4,634 |

| 2024-Q1 | 1,189 | €4,792 |

| 2024-Q2 | 1,348 | €4,722 |

| 2024-Q3 | 1,551 | €4,815 |

| 2024-Q4 | 1,473 | €4,750 |

| 2025-Q1 | 1,539 | €4,821 |

| 2025-Q2 | 1,471 | €4,826 |

DVF is published with a delay (registration/processing lag). We compute €/m² only for records with valid transaction value and built area, then aggregate by quarter using median/IQR (to reduce outliers). Use these figures as a directional indicator for trends and seasonality, not as an official appraisal. For a specific property, micro-location and building quality dominate.

Buying with crypto-origin funds? We explain how crypto → EUR conversion, source-of-funds checks, and the notary closing work in France. Read the crypto guide.

Related: Stablecoin conversion strategy · Tax planning · PSAN-licensed providers

Why Buy in Nice?

Lifestyle Benefits

- Climate: Mediterranean climate with mild winters (10-15°C) and warm summers (25-30°C)

- Culture: World-class museums, opera, festivals (Jazz Festival, Carnival)

- Gastronomy: Michelin restaurants, traditional Niçoise cuisine

- Transport: Nice Côte d'Azur Airport (2nd busiest in France), TGV to Paris (5.5h)

Investment Potential

| Property Type | Size | Price Range |

|---|---|---|

| Studio | 25-35m² | €180,000-280,000 |

| 2-bedroom | 50-70m² | €350,000-550,000 |

| 3-bedroom | 80-120m² | €500,000-900,000 |

| Villa | 200-400m² | €1,500,000-5,000,000+ |

Neighborhoods Guide

Mont Boron — €8,000-12,000/m²

The most prestigious address in Nice. Hillside villas with panoramic sea views, private gardens, and maximum privacy. Home to diplomats, entrepreneurs, and celebrities.

Best for: Luxury buyers, privacy seekers, families wanting space

Cimiez — €5,000-7,000/m²

Historic elegance with Belle Époque architecture, the Matisse Museum, and Roman ruins. Tree-lined streets, excellent schools, and a refined atmosphere.

Best for: Families, culture lovers, those seeking authentic Nice

Port — €6,000-8,000/m²

Vibrant waterfront living with yachts, restaurants, and nightlife. Mix of renovated historic buildings and modern developments. Walking distance to Old Town.

Best for: Young professionals, investors, those wanting action

Market Trends 2025

Nice property prices have increased 4.2% in 2024, with Mont Boron and Cimiez leading growth. Q1 2025 shows continued demand, especially from:

- UK buyers (post-Brexit clarity)

- US buyers (dollar strength)

- Middle East buyers (political diversification)

Best time to buy: November-February. Less competition, sellers more motivated. We've achieved 5-8% better prices in off-season purchases.

Investment Note: Villa in Nice (January 2026)

Key takeaway: The entry window looks favorable — as France moves into an early-expansion scenario, the buyer's negotiating position is often stronger today than in the phase when the recovery becomes obvious to most market participants.

Important: the material below is an analytical note and does not constitute personalized investment advice.

1. Macro: France and the Business-Cycle Phase

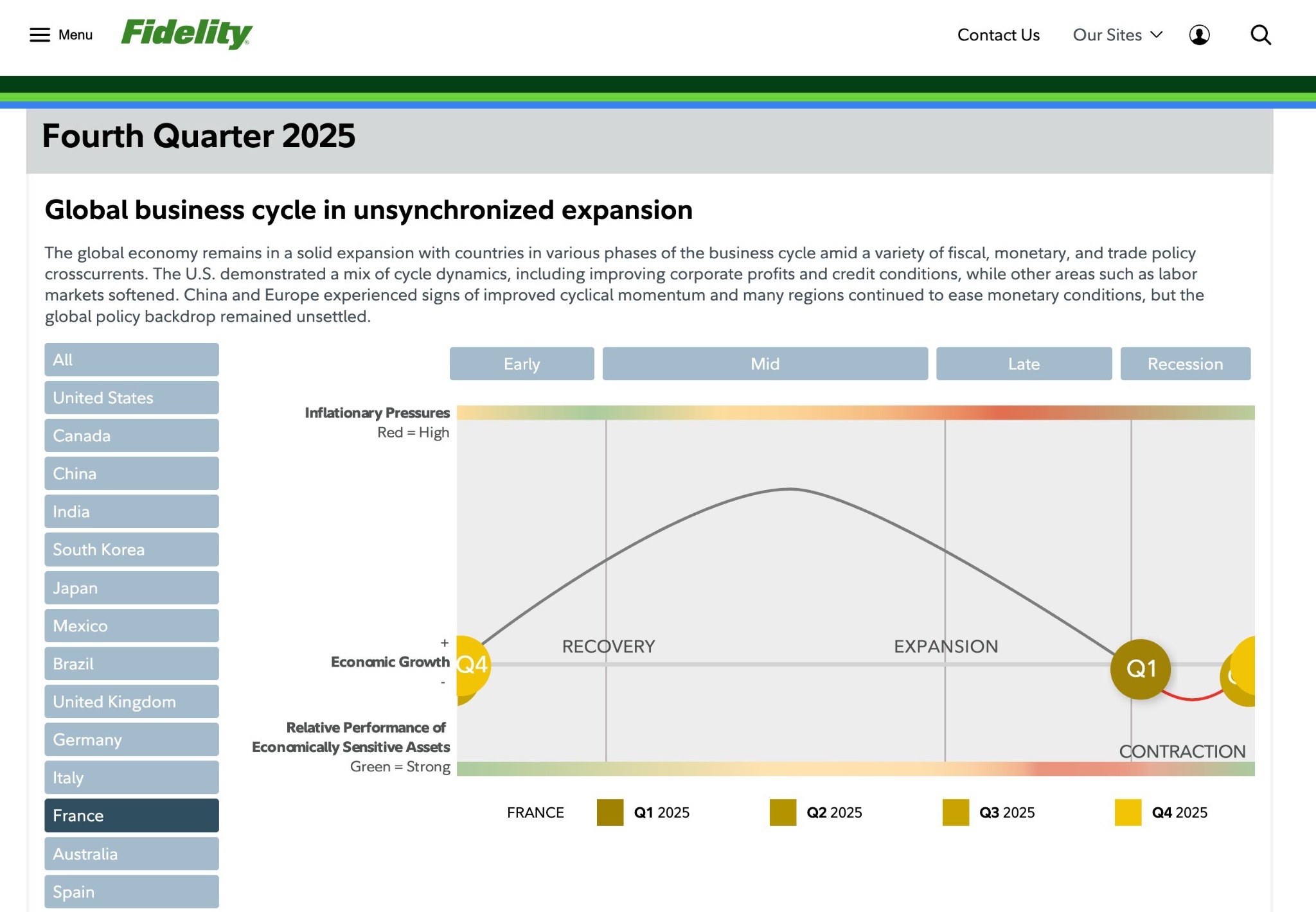

According to current information (Fidelity, Q4 2025), as of January 2026 France is positioned in early expansion / recovery after contraction.

Practical implication for real estate: as financial conditions normalize and confidence improves, demand tends to return gradually, and the window for meaningful seller discounts typically narrows.

Figure 1. Business-cycle view (selected country: France). Source: Fidelity International — global investment management company.

2. Why This Supports Real Estate Interest Early in the Cycle

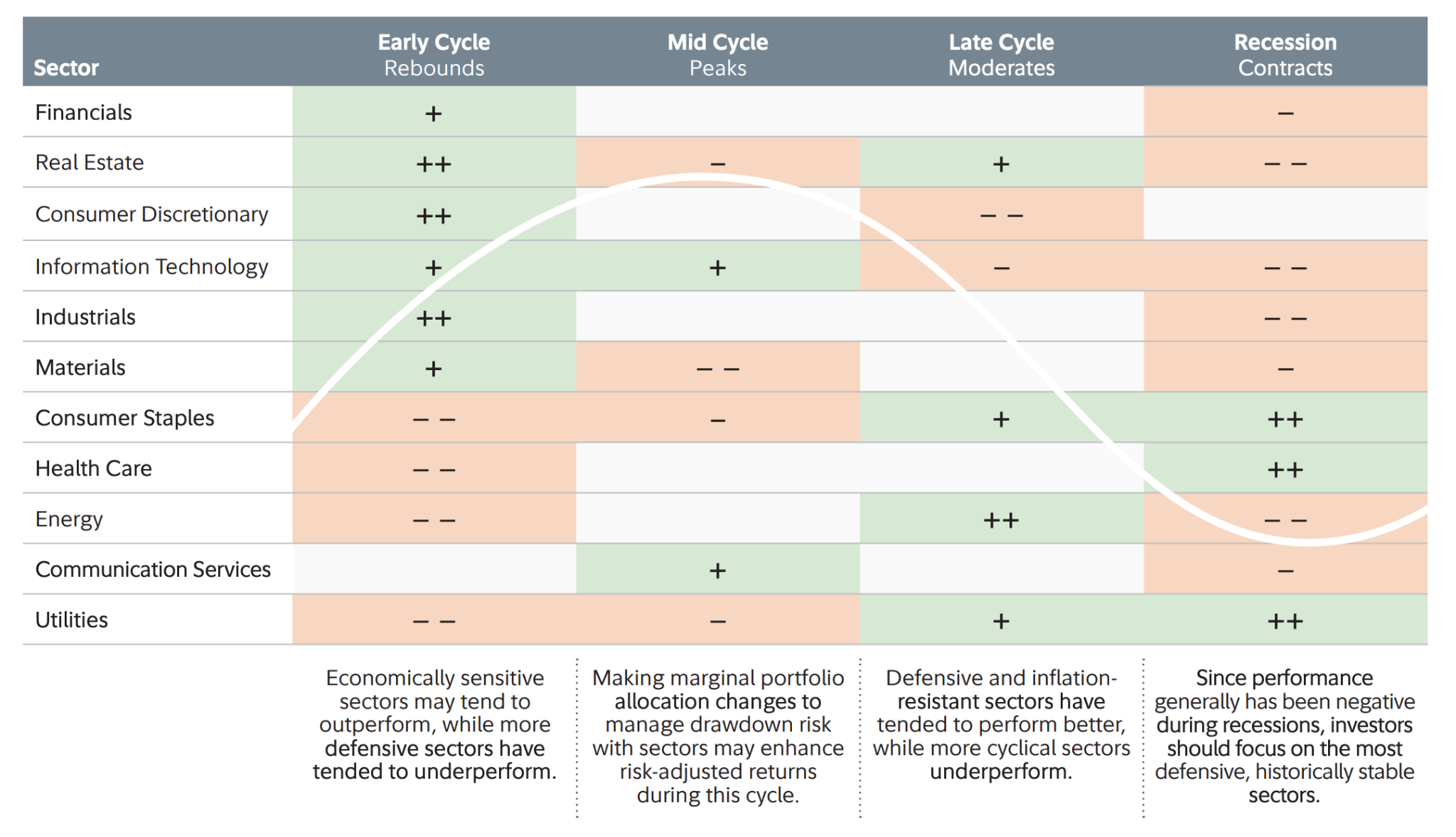

In Fidelity's framework, early-cycle (recovery) conditions have historically been supportive for rate-sensitive segments such as real estate. This does not guarantee the performance of any specific villa, but it provides a macro argument that, after exiting contraction, demand-side pressure on prices more often eases than intensifies.

Figure 2. Sector-rotation table: "Real Estate" is marked "++" in "Early Cycle / Rebounds". Source: Fidelity International.

3. Nice: Prices and Transaction Activity

Negotiation-wise, reduced activity alongside resilient prices often means more room for discounts today — especially on properties with renovation needs or specific constraints. As the cycle recovery progresses, buyer competition can intensify.

See the DVF price chart above for quarterly median prices and transaction volumes.

4. Practical Investment Thesis (Villa Segment)

Why "now" may be better than "later":

- Nice looks resilient on prices, while transaction volume remains below peak levels — often a sign of a more negotiable market

- If the cycle phase truly shifts toward early expansion, the discount window can gradually close

- In the premium villa segment, micro-quality matters as much as the macro backdrop: views, privacy, land, access quality, legal cleanliness

Ready to Find Your Nice Property?

Contact us for a free consultation. We'll discuss your requirements, budget, and timeline.

See also: Cannes · Antibes · Monaco area

Learn more: How our buyer's agent service works · How it works · Contact us

Last updated: January 2026. Data from notarial records and our transaction database.