The core idea: tax on gains vs tax on capital

For many buyers, the biggest misunderstanding is thinking: “France takes 30% of the whole crypto amount.”

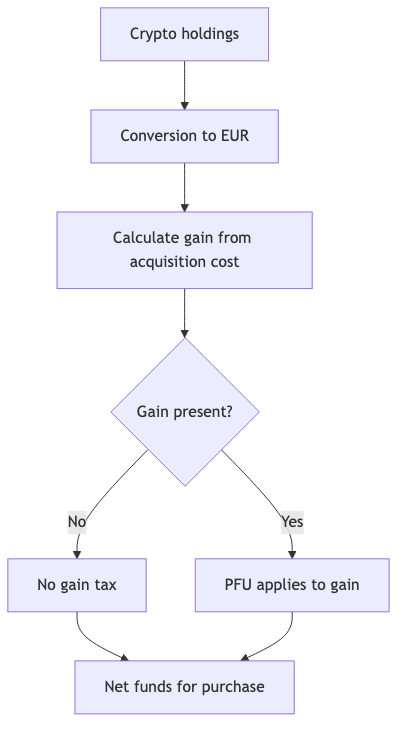

In simplified terms, the tax logic is usually closer to:

- If there is a gain, tax may apply to the gain (the difference between acquisition value and value at conversion).

- The property purchase is taxed under normal rules (notary fees and standard acquisition taxes).

This page is educational. Your exact treatment depends on factors like tax residency, acquisition history, and how the conversion is structured.

Reference anchor: crypto gains are commonly discussed under CGI 150 VH bis (reference only — confirm current rules with qualified advisors).

Typical scenarios (stablecoin vs BTC/ETH)

| Scenario | What to check | Why it matters |

|---|

Hub overview:

Example calculation (simple numbers)

Illustrative example (not advice):

- Acquisition value: €400,000

- Value at conversion to EUR: €500,000

- Gain: €100,000

If PFU 30% applies to the gain, the order of magnitude could be:

- €100,000 × 30% ≈ €30,000 tax on the gain

In practice, details can differ. The key point is: the tax point is typically the gain at conversion, not “30% of everything you own”.

Conversion moment and documentation

Operationally, conversion is where:

- the gain (if any) is crystallized, and

- banks/notaries may request evidence for AML (“source of funds”).

To reduce delays:

- align conversion timing with the notary timeline:

/en/how-it-works - prepare your documentation pack early:

/en/guide/crypto/source-of-funds - make sure the workflow is compliant:

/en/guide/crypto/legal-framework

Common misconceptions (quick fixes)

- “I pay 30% on the whole crypto amount.” Often wrong — the gain is the key point.

- “Stablecoins always mean zero tax.” Not necessarily; it depends on history and local rules.

- “I can convert at the last moment.” Late preparation often creates delays and questions.

- “The notary will accept any crypto transfer.” Settlement usually runs in EUR, with standard checks.

Next step: get a tailored view

If you’re planning a crypto-origin purchase on the French Riviera, the safest path is to pre-check residency, estimate potential gains, and prepare a clean conversion workflow.

- Start here:

/en/contact - Back to the hub:

/en/guide/crypto

Sources

- BOFiP — official tax doctrine

- impots.gouv.fr — French tax administration

- service-public.fr — official public guidance

- AMF — regulator context (PSAN)

Disclaimer: Educational content only (not tax advice). Always confirm your treatment with qualified advisors, especially for cross-border situations.