Buy French Riviera property with crypto-origin funds by converting to EUR via a regulated provider and preparing a clear source-of-funds pack for the notary/bank.

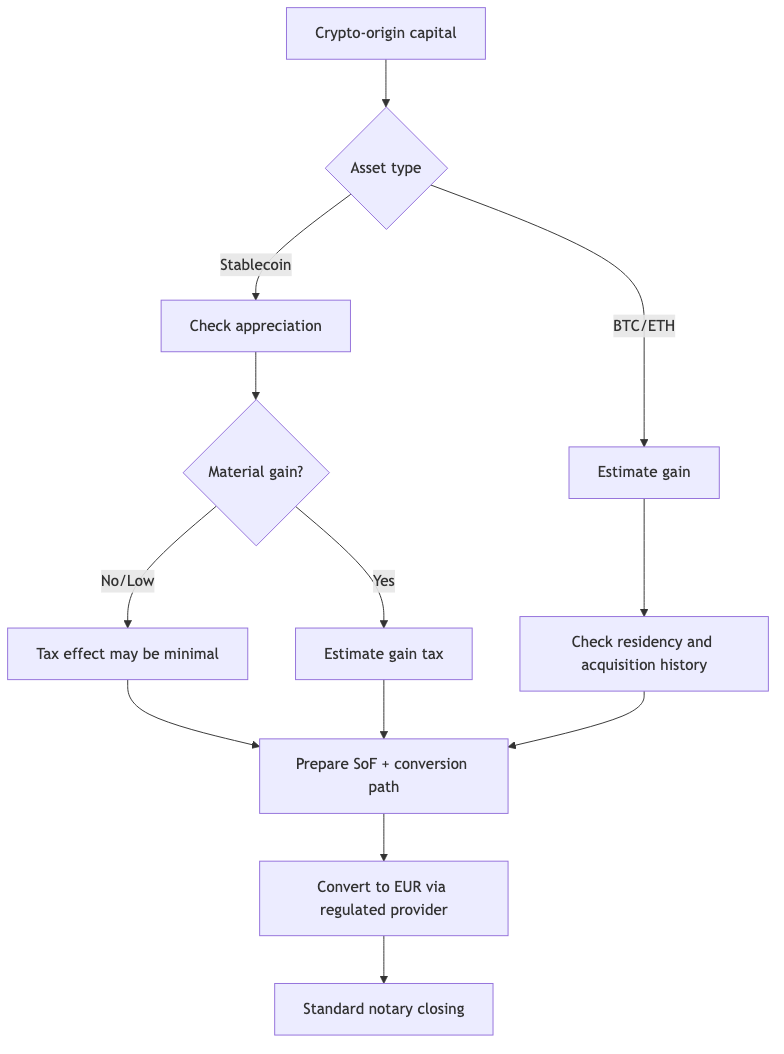

The simplest path (stablecoin-first)

If your capital is already in stablecoins (or can be converted to stablecoins early), the workflow is often operationally simpler:

- you can reduce price volatility during the property search;

- the “gain at conversion” can be minimal if there is no appreciation (still depends on your tax profile and accounting method);

- conversion and settlement steps become easier to document.

For a deeper look at stablecoin timing and tradeoffs:

/en/guide/crypto/stablecoin-strategy

If you want a clean, fast start, do a short pre-check before you shortlist properties:

/en/contact(free consultation)

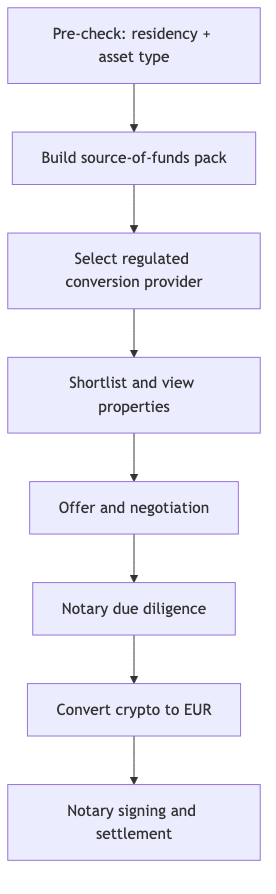

The standard process (crypto → EUR → notary)

On the French Riviera, the “crypto-funded purchase” usually means crypto is the origin of funds, while the closing chain is in EUR.

Typical steps:

- Define target budget and timeline (include compliance preparation).

- Prepare source-of-funds evidence (ownership + history + trail).

- Choose a compliant conversion path (regulated provider + banking rails).

- Shortlist properties and run viewings (or virtual tours).

- Make an offer and negotiate.

- Due diligence (documents, copropriété, permits, technical checks).

- Convert to EUR (timed to the closing chain).

- Notary signing and settlement (standard French process).

To understand timelines end-to-end:

/en/how-it-works

Taxes in one screen (France)

The key idea (simplified): tax is usually about the gain, not the full amount.

If you bought €400k worth of crypto and later it is worth €500k at conversion time, the gain is €100k. Under PFU 30% (typical pattern), the order of magnitude might be ~€30k on the gain (illustrative, not advice).

For a practical breakdown and scenarios:

Legal & compliance (PSAN, AML, notary)

Two things matter most for a smooth deal:

- Clear conversion path (crypto → EUR via a regulated provider, with evidence)

- Clean source-of-funds pack (ownership + history + trail + conversion records)

Start here:

/en/guide/crypto/legal-framework/en/guide/crypto/source-of-funds/en/guide/crypto/psan-providers/en/guide/crypto/rental-and-fees

Monaco vs France (where conversion happens)

Monaco and France differ in institutions, but your outcome depends on where you are tax resident, where the conversion happens, and how the closing chain is structured. Avoid “one-size-fits-all” claims; treat this as a case-by-case planning topic.

Detailed comparison:

/en/guide/crypto/monaco-vs-france

If you are considering Monaco as part of your plan, start with a consultation:

Next step: reduce risk early

If you want to buy on the French Riviera with crypto-origin capital, the fastest way to avoid delays is to prepare documentation early and align conversion timing with the notary process.

- Start here:

/en/contact - Our buyer-side service:

/en/buyer-agent

Sources

- AMF (France) — general regulator information

- BOFiP (France) — official tax doctrine

- impots.gouv.fr — French tax administration

- EUR-Lex — EU legal texts (MiCA context)

- service-public.fr — official public guidance

Disclaimer: Educational content only (not legal/tax advice). Rules and requirements vary by residency, asset history, notary, and banking policy. Always confirm with qualified advisors.