Why source-of-funds matters (and where delays happen)

Even when the closing is in EUR, crypto-origin capital can trigger extra questions. Delays usually happen when:

- the history is complex (many wallets, transfers, exchanges), and

- documentation is prepared late, under time pressure.

Start with the overview:

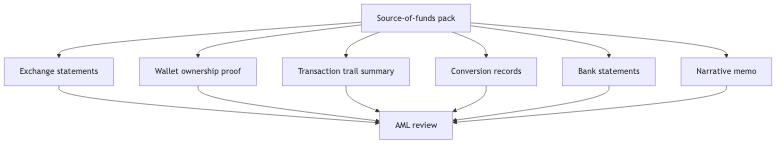

A practical “SoF pack” (what to prepare)

Use this as a practical checklist. Exact requirements vary by bank/notary.

| Item | Why it matters | Who typically asks |

|---|

Proof of ownership (wallet / exchange / account)

The core requirement is often simple: reviewers need confidence that you control the assets you claim, and that the trail is consistent.

If your history includes multiple wallets, prepare a clear mapping (addresses → owner → exchange account).

Conversion records (crypto → EUR)

In most French closings, EUR must arrive in the notary chain. Keep:

- conversion confirmations,

- invoices/receipts where provided,

- bank statements showing EUR proceeds,

- dates and references consistent across documents.

Legal/compliance context:

Practical note: reporting accounts (forms 3916 / 3916 bis)

If you are tax resident in France and use foreign exchanges or custodial accounts, you may need to declare them via forms 3916 / 3916 bis. This is separate from the property transaction but often comes up in compliance discussions. Confirm your obligations with a qualified advisor.

Red flags (and how to avoid them)

Common red flags that slow down deals:

- unclear P2P origin with missing counterparties;

- missing acquisition evidence (no records, no consistent story);

- last-minute conversion planning with no time buffer;

- inconsistent amounts/dates across documents.

Avoid them by preparing the pack early and keeping a clean conversion path.

Timeline: what to do before you choose a property

If you want speed in execution:

- Build your SoF pack first.

- Pre-check conversion rails and timeline.

- Only then shortlist and negotiate properties.

Purchase flow overview:

/en/how-it-works

Next step: we can review your pack

If you want, we can do a quick pre-check to identify gaps and reduce the risk of delays during the closing chain.

- Start here:

/en/contact - Buyer-side service:

/en/buyer-agent

Sources

- AMF — regulator context (PSAN)

- service-public.fr — official public guidance

- impots.gouv.fr — French tax administration

Disclaimer: Educational checklist only (not AML, legal, or tax advice). Requirements vary by institution and case profile. Always confirm with qualified professionals.