What “crypto-funded purchase” means in France

For real estate on the French Riviera, “crypto-funded” usually means:

- your capital originates from crypto, but

- the property settlement is done in EUR through the standard notary process.

So the main legal/compliance focus is not “paying in crypto”, but documenting and converting the funds in a way banks and notaries can accept.

If you want the overview first:

Legal tender and acceptance (what crypto is not)

Crypto is not legal tender in France, and no party is obliged to accept crypto for a property price, fees, or rent. In practice, the settlement chain runs in EUR; any crypto use is by agreement only and typically happens before settlement (conversion to EUR).

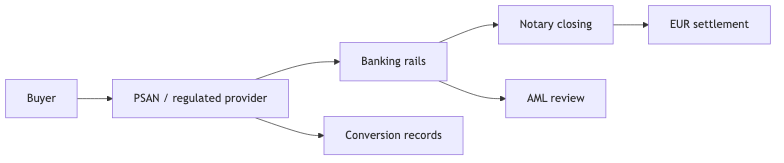

Where compliance shows up: provider, bank, notary

Even if you are paying in EUR at closing, crypto-origin funds can trigger additional questions. In simplified terms:

- Conversion provider: produces records of conversion crypto → EUR.

- Banking rails: may apply AML policy to incoming proceeds and require evidence.

- Notary: needs confidence that the funds are lawful and properly documented for settlement.

Your goal is to keep the trail clean and consistent across all parties.

AML / KYC: what is checked and why

AML checks generally focus on:

- Ownership / control: can you prove you control the accounts/wallets involved?

- Acquisition history: do you have evidence for how the crypto was acquired?

- Transaction trail: can you explain major transfers, mixing, and counterparties?

- Conversion: is the conversion to EUR done via a compliant, well-documented path?

Practical documentation checklist is here:

/en/guide/crypto/source-of-funds

Fees, rent, and agency rules (Loi Hoguet / LCB-FT)

If your purchase involves agency fees or rent, note that agencies in France are regulated under Loi Hoguet and subject to LCB-FT (AML) obligations. In practice, most professional intermediaries require EUR transfers through regulated banking rails and can apply enhanced checks for higher-risk profiles. Treat this as a compliance point early and avoid assumptions about crypto acceptance.

Contract & settlement: practical implications

Operationally:

- time your conversion so that EUR proceeds are available for the notary chain when needed;

- avoid last-minute changes in the source account;

- expect that some banks/notaries require extra lead time.

End-to-end purchase timeline:

/en/how-it-works

Monaco vs France: a safe way to think about it

Monaco and France differ in institutions, but the key question is still: where are you resident, where does conversion happen, and how does EUR reach the notary chain? Treat “rules” as case-by-case.

Next step: reduce risk early

If you want to buy with crypto-origin capital, the best risk reducer is early preparation:

- Start with a pre-check:

/en/contact - Buyer-side representation:

/en/buyer-agent

Sources

- AMF — France financial markets authority

- service-public.fr — official public guidance

- EUR-Lex — EU legal texts (MiCA context)

Disclaimer: Educational content only (not legal advice). Requirements vary by notary, bank, residency and transaction profile. Always confirm with qualified professionals.